Activated patients.

Improved outcomes.

With automated tools for intake, access, payments and more, Phreesia supports patients in taking a more active role in their care and helps you drive outcomes that matter.

Trusted by 3,900+ healthcare organizations nationwide

Empower patients to take an active role in their care

When patients feel disengaged and overwhelmed, they’re less likely to understand how to manage their health. But by focusing on patient activation, you can equip patients with the knowledge, skills and confidence they need to actively participate in their care.

Measurable results for your staff and patients

clients would recommend Phreesia to a friend or colleague

of clients say Phreesia creates tangible outcomes for their organization

clients say Phreesia provides high-quality, proactive customer service and support

of patients are satisfied with their experience using Phreesia

Ready to see what Phreesia could do for you? Use our calculators >

Fill your administrative staffing gaps

Between appointments, registration, insurance verification and patient outreach, your organization has lots of tasks to manage—and limited resources to manage them. But operating efficiently isn’t about finding more people to do the work. It’s about helping your staff work smarter, not harder.

Browse our resources

Keep tabs on our latest announcements, media coverage, expert insights and more.

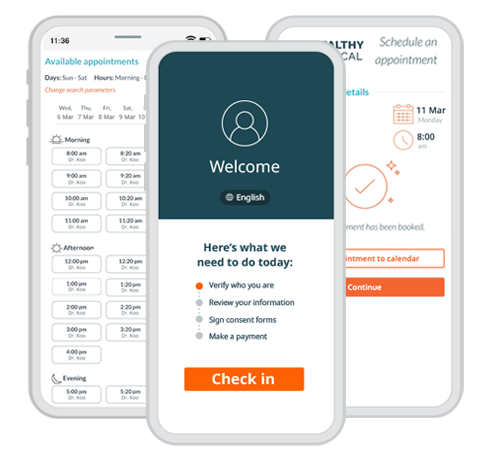

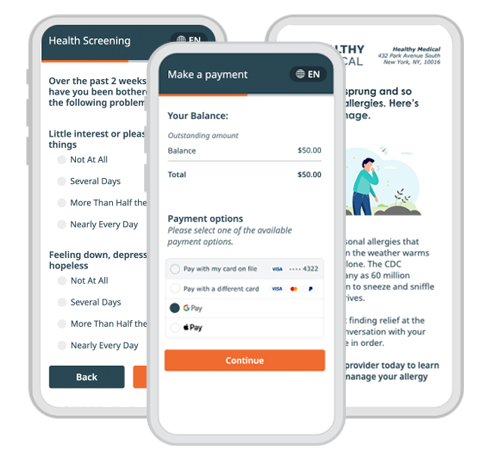

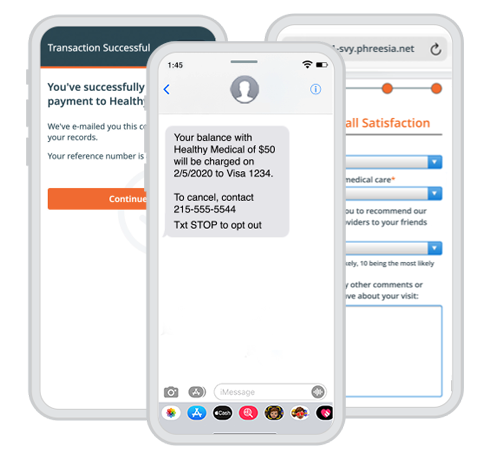

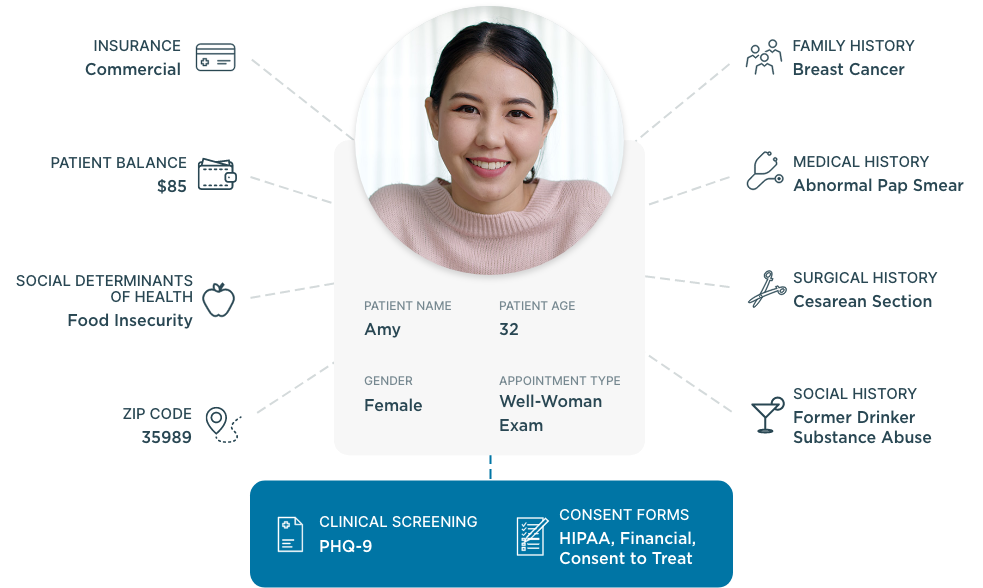

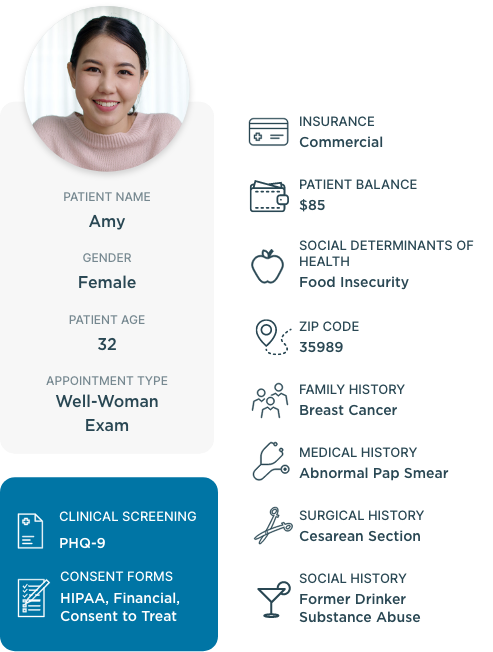

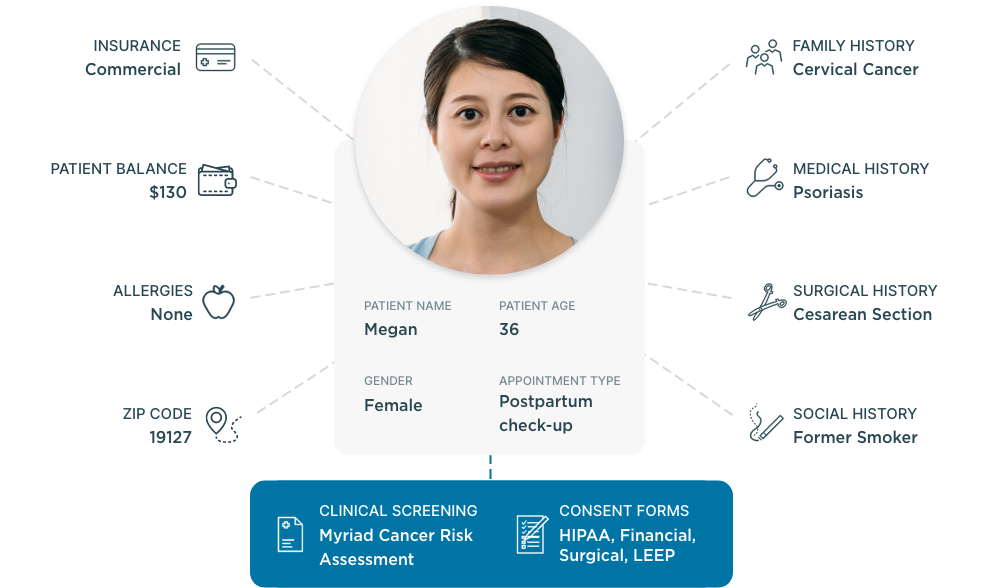

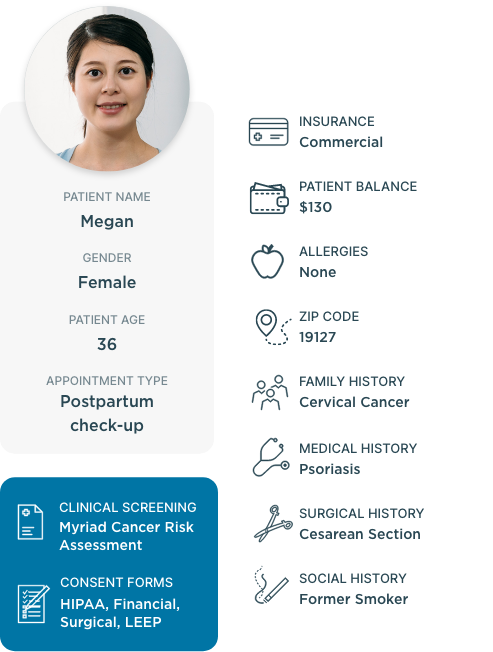

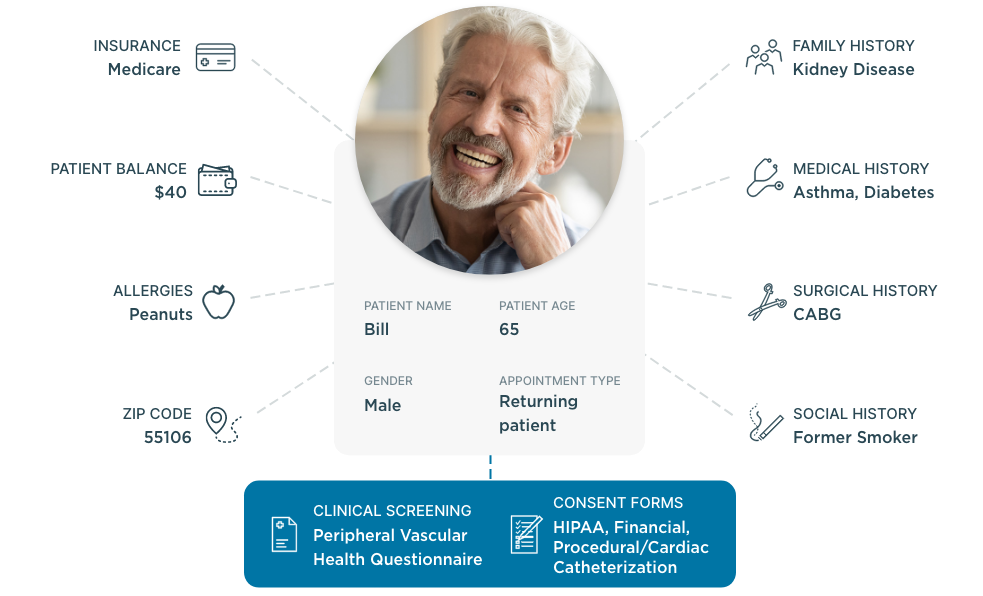

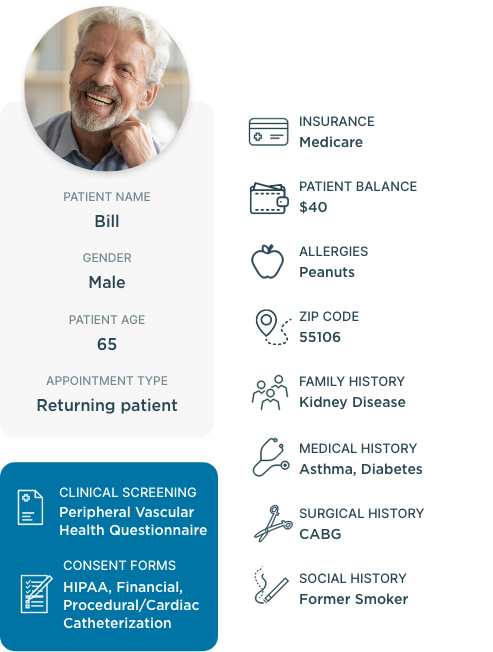

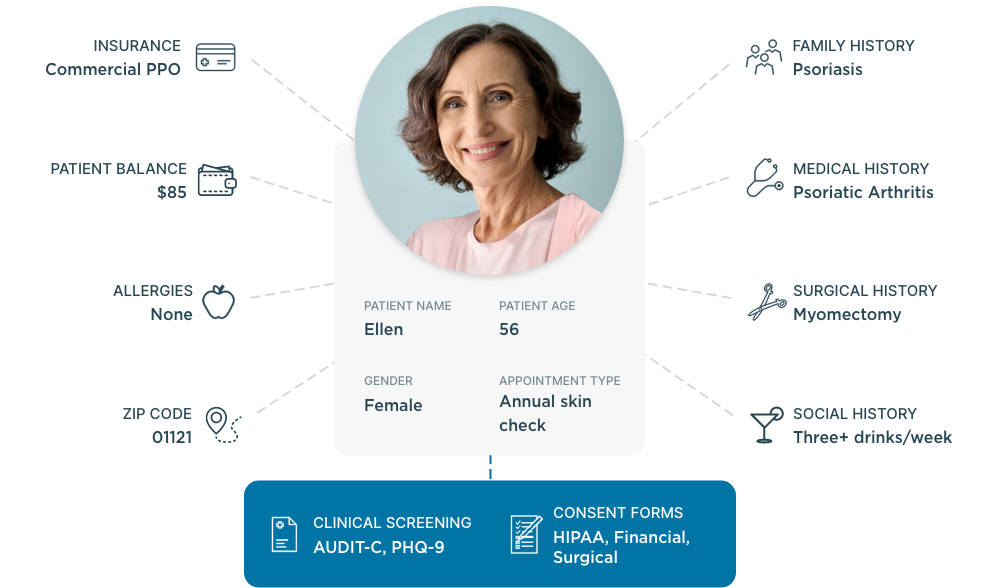

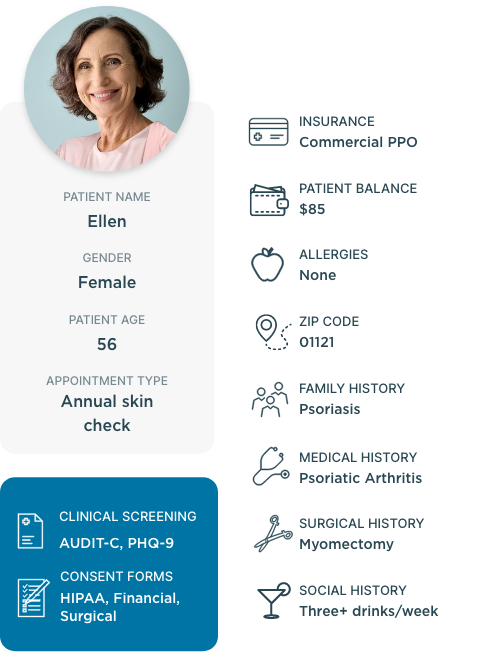

Patient engagement journey

Support your organization’s digital front-door strategy and engage patients at every step of their healthcare

journey with native applications and a library of APIs.

Select your organization type to see a tailored solution

What our clients say about us

Our bidirectional integrations

Can’t find your PM/EHR? Don’t worry! Phreesia is easily integrated using open standards, including HL7, FHIR, CCD, CSV and more.